The value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price).

Market Value = Base Value - xVA

See the xVA description on Wikipedia

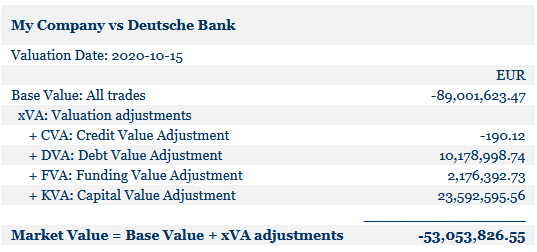

Example of xVA adjustments

Before the Great Financial Crisis, the market valuation was done by market participants following simple assumptions.

After the financial crisis, the nature of the actual risk embedded in financial instruments could not be ignored and the calculations of xVA is therefore required. The relevant adjustments are a consequence of taking into account the counterparty, funding and capital risk.

International Financial Reporting Standards (IFRS) require these adjustments to be included in the financial reporting of any company following these accounting standards.

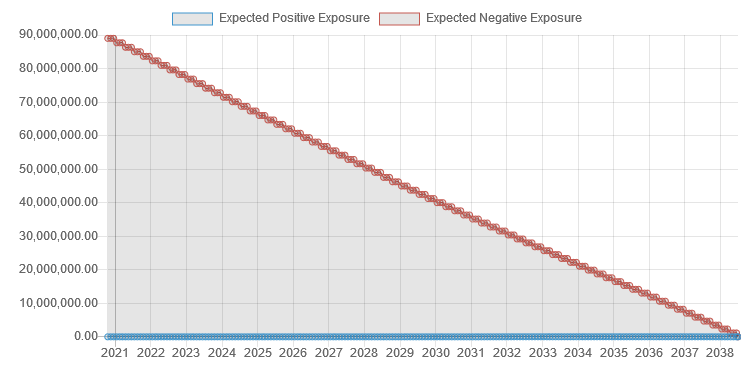

Example of exposure calculations

The exposure is crucial for a market consistent valuation. The expectation expresses how the base value of the portfolio are likely to develop from current date until expiry.

This is applied in the quantification of the embedded credit risk between the two parties in the actual trade.

CVA and DVA are measures of the value of embedded credit risk.

Also, FVA is a measure of the cost and benefits of funding the portfolio due to inadequate collateral posting by the parties.

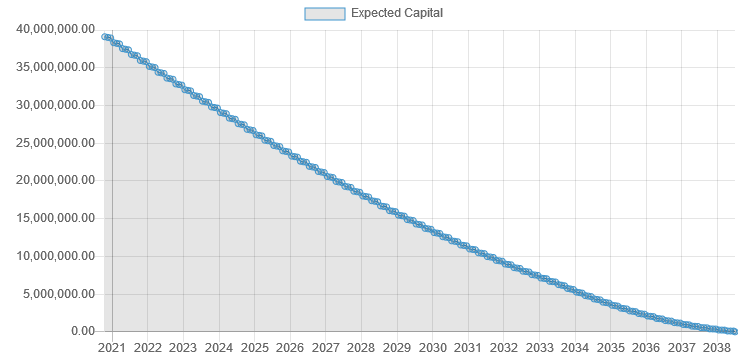

Example of capital calculations

Regulatory capital is a legal requirement for financial institutions holding financial instruments.

The Cost of Capital is an essential part when financial institutions enters and evaluates their portfolio of financial instruments, and the term is therefore an important part of the market value embedded in financial instruments.

The entire lifetime capital requirement faced by the bank must be included.

Calculation of expected capital requires calculation of both Counterparty Credit Risk and CVA Capital.

xva.cloud approximates this by applying the schematic approach outlined by SA-CCR, FIRB and BA-CVA.

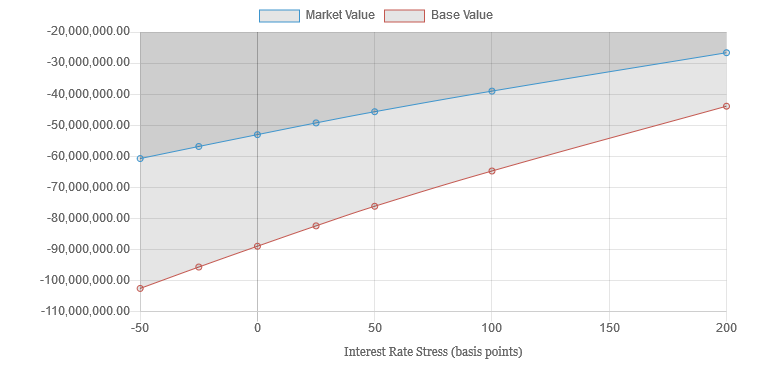

Example of xVA risk

Risk sensitivities is becomes important as traditional risk measures based on base values are inadequate for capturing the total risk.

xva.cloud calculates risk for all xVA adjustments.

The calculation applies a bump-and-run methodology, where each risk factor (interest rate, FX, etc.) is stressed in isolation and a complete re-calculation is performed.

All valuation adjustments (xVA) are re-calculated in all scenarios.

The calculation engine also includes risk sensitivies for major underlying risk factors (Interest Rates, FX rates, etc.).